Reading this article on TechCrunch today (Putting Square’s $5B valuation in context), we couldn’t help but notice that after some fantastic growth of c. $2.3m in transactions per day, 2014 isn’t expected to be quite so stellar if these figures are correct.

Reading this article on TechCrunch today (Putting Square’s $5B valuation in context), we couldn’t help but notice that after some fantastic growth of c. $2.3m in transactions per day, 2014 isn’t expected to be quite so stellar if these figures are correct.

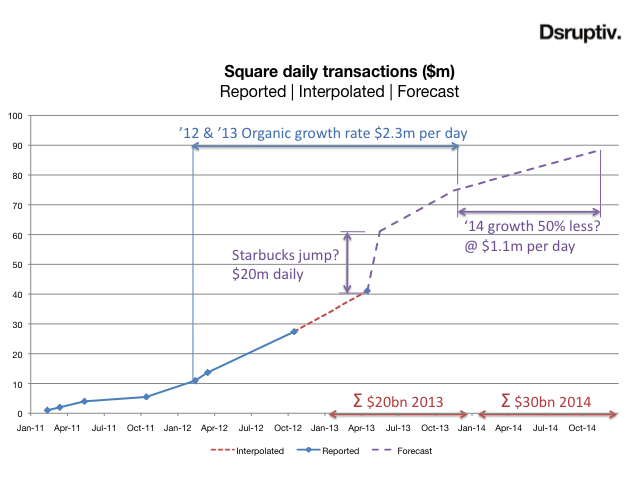

The chart below and spreadsheet (available here) show our crude calculations that make the maths work, but taking the figures provided by TechCrunch, and interpolating and forecasting the results, to move from a rumoured $20BN annual transactions in 2013 to $30BN in 2014 would equate to a daily transaction growth rate of approx. $1.1m per day, 50% down on the organic growth rate of the preceding two years. This assumes an inorganic growth ‘jump’ in transactions of $20m per day thanks to the tie-in with Starbucks.

The real question in our mind is to what degree Square’s growth has been sourced from taking market share from traditional merchant acquirers vs. signing up businesses that previously only accepted cash and checks. If, as some commentators suggest, Square books 1% of transaction value as net revenue, a $5BN valuation based on $20BN of transaction volume in 2013 is a 25x multiple on net revenues of $200m. It’s hard to see how that multiple can be sustained if growth tails off, particularly if traditional merchant acquirers move to defend their market shares and card processing margins continue to fall. Now is a good time to raise a cool $135m.

[14 Jan 2013 9am: Edited following Bloomberg report]